Have you ever wondered about the differences between accounting vs finance? Many business leaders use the terms interchangeably, but accounting and finance are not the same. Knowing the distinction can transform how you run your company.

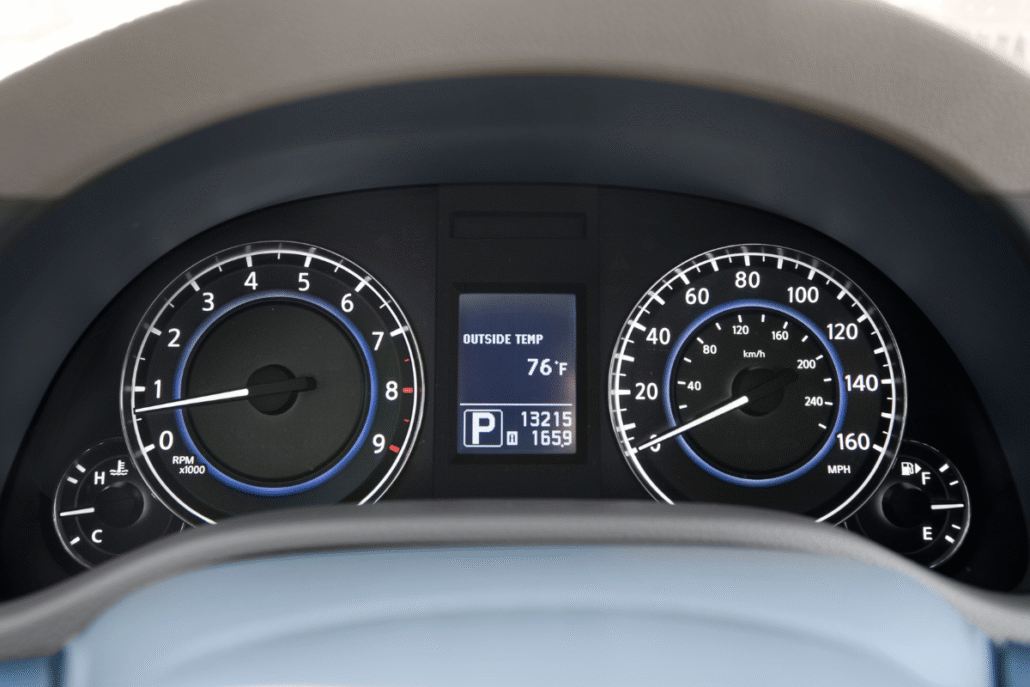

If your business were a car, accounting would be the gauges on your dashboard — the odometer, fuel gauge, and temperature gauge — that tell you exactly how far you’ve traveled, how much fuel you have left, and the current status of your engine. Finance would be your navigation system, mapping the best route to your destination, helping you adjust when plans change, and ensuring you get there as efficiently as possible.

What is Accounting? (Your Car’s Gauges)

The Corporate Finance Institute (CFI) defines accounting as “the recording, maintaining, and reporting of a company’s financial records.” (CFI)

The Association for Financial Professionals (AFP) adds that “Accounting is focused on the past. They record the transactions, report the information to management and stakeholders, and ensure compliance in their reporting through a standardized set of rules.” (AFP)

In practice, accounting means:

- Recording every transaction accurately

- Preparing financial statements such as the income statement, balance sheet, and cash flow statement

- Ensuring compliance with tax laws and accounting standards

- Creating a clear, verifiable record of the company’s financial history

Just like your car’s gauges, accounting provides precise readings of what has already happened and your current status. It doesn’t decide where you’re going — it simply gives you the facts so you can drive safely and legally.

What is Finance? (Your Navigation System)

CFI defines finance as “the management of money and investments for individuals, corporations, and governments.” (CFI)

Finance uses the historical data from accounting to:

- Forecast revenue, expenses, and cash flow

- Build budgets and long-range plans

- Evaluate investment opportunities

- Model “what if” scenarios to guide decision-making

The perspective is different too. Accounting typically focuses on the past, while finance focuses on the future.

In the car analogy, the navigation system takes the information from your gauges and uses it to chart the best route to your destination. It can reroute you around traffic, help you decide whether to take the toll road, and anticipate fuel stops before you run low.

This is where Momentum CFO comes in. We focus on the navigation system, helping growing businesses use forward-looking finance to guide strategy. We work alongside your accounting team to turn accurate historical records into forecasts, scenarios, and plans that point your business in the right direction and keep it on course.

Where FP&A Fits In

Financial Planning & Analysis (FP&A) is a specialized area within finance focused on driving strategy and improving decision-making. AFP explains: “FP&A is future-focused. These professionals improve business decisions across the organization by supporting the allocation of capital to its most productive use.” (AFP)

FP&A professionals often:

- Build financial models to evaluate different strategic options

- Partner with business leaders to create budgets and forecasts

- Analyze performance metrics and trends to inform leadership decisions

At Momentum CFO, FP&A is at the core of what we do. Think of it as the advanced navigation system that considers traffic patterns, fuel efficiency, and weather so you can reach your business goals faster, with fewer surprises, and with the confidence that you are taking the best route available.

Key Accounting and Finance Differences at a Glance

| Aspect | Accounting | Finance |

| Time Focus | Past | Future |

| Primary Goal | Accuracy and compliance | Strategy and decision-making |

| Responsibilities | Recording transactions, managing accounts receivable and payable, preparing financial statements, auditing financial records, ensuring compliance with regulations | Strategic planning, budgeting, forecasting future performance, scenario analysis, analyzing results and trends, evaluating potential investments, managing risk |

| Questions Answered | “What happened?” | “What might happen?” |

| Skill Sets | Attention to detail, accuracy, organization | Analytical and quantitative thinking, problem-solving, planning, influencing decisions |

Overlap in Smaller Businesses

While larger companies have both accounting and finance staff, in smaller companies, accounting staff such as the Controller, may handle both accounting and some finance tasks. While this can cover basic needs, it often leaves finance in a reactive mode. Without a dedicated navigation system, you risk missing better routes, failing to spot risks early, or making short-term decisions that do not align with long-term goals.

Why the Differences Matter

Understanding the differences between accounting and finance helps you:

- Avoid gaps in financial insight

- Use the right expertise for the right task

- Make better, faster, decisions,

- Support growth with both accuracy and strategy

In short, without the gauges you lose track of your status. Without the navigation system you may keep driving in circles.

The Bottom Line

Understanding the difference between accounting vs finance is more than semantics. It’s about ensuring your business has both an accurate record of its past and a clear, strategic plan for its future. Accounting keeps your record straight. Finance charts your course forward. Together, they help you run your business with clarity, confidence, and purpose.

Ready to put a high-performing navigation system in place for your business? Let’s talk!